nd sales tax rate 2021

ND State Sales Tax Rate. 100 rows WHAT IS THE SALES TAX RATE IN NORTH DAKOTA.

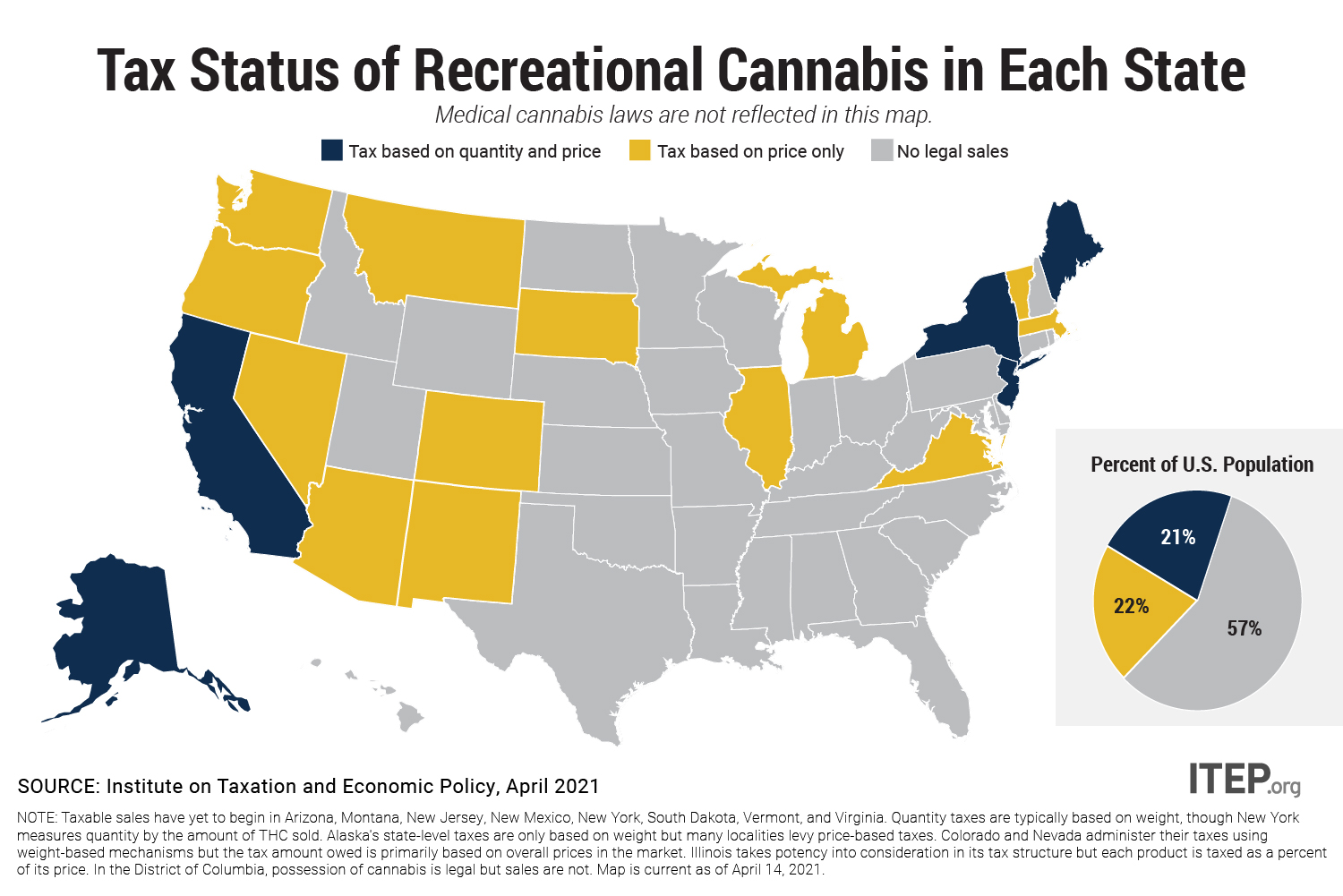

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

2021 Locally Assessed Property 2021 SBOE Locally Assessed Property.

. Schedule ND-1NR line 22 to calculate their tax. It does not include special taxes such as. Their North Dakota taxable income is 49935.

Pursuant to Ordinance 6417 as adopted June 23 2020 the boundaries of the City of Bismarck will change for sales and use. The tax rate for Hankinson starting October 1 2021 will be 3. North Dakota sales tax is comprised of 2 parts.

Exemptions to the North Dakota sales tax will vary by state. If your ND taxable. Taxpayers are residents of North Dakota and are married filing jointly.

This is the total of state county and city sales tax rates. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. The minimum combined 2022 sales tax rate for Bismarck North Dakota is.

Start filing your tax return now. North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. There are a total of 213 local tax jurisdictions across the state collecting an average local tax of 096.

Hankinson At the present time the City of Hankinson has a 2 city sales use and gross receipts tax. While many other states allow counties and other localities to collect a local option sales tax North Dakota does not permit local sales taxes to be collected. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods.

TAX DAY NOW MAY 17th - There are -438 days left until taxes are due. 2022 North Dakota Sales Tax Table. Find your North Dakota combined state and local tax rate.

The North Dakota sales tax rate is currently. Gross receipts tax is applied to sales of. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Effective October 1 2021 the City of Hankinson has revised their ordinance to increase its city sales use and gross receipts tax by 1. The state sales tax rate in North Dakota is 5 but. City Total Sales Tax Rate.

Look up 2021 sales tax rates for Grand Rapids North Dakota and surrounding areas. North Dakota Sales Tax Rates 2021. North Dakota State Sales Tax Rates.

The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. 30 rows The state sales tax rate in North Dakota is 5000. The County sales tax rate is.

City of Bismarck North Dakota. Did South Dakota v. Over the past year there have been sixteen local sales tax rate changes in North Dakota.

The North Dakota State Sales Tax is collected by the merchant on all qualifying sales made within North Dakota State. New farm machinery used exclusively for agriculture production at 3. The state sales tax rate in North Dakota is 5 but you can customize this table as.

Please use the search option for faster searching. Tax rates are provided by Avalara and updated monthly. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

North Dakota has state sales tax of 5and allows local governments to collect a local option sales tax of up to 3. The North Dakota State North Dakota sales tax is 500 the same as the North Dakota state sales tax. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

If you need access to a database of all North Dakota local sales tax rates visit the sales tax data page. Get the benefit of tax research and calculation experts with Avalara AvaTax software. Local lodging local lodging and restaurant alcohol tobacco excise taxes.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of 596 when combined with the state sales tax. Click here for a. The base state sales tax rate in North Dakota is 5.

2022 North Dakota Sales Tax Table. Integrate Vertex seamlessly to the systems you already use. Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax rates and boundaries for North Dakota.

The sales tax is paid by the purchaser and collected by the seller. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. The Bismarck sales tax rate is.

Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck will change for sales and use tax purposes effective January 1 2021. With local taxes the total sales. We have tried to include all the cities that come under North Dakota sales tax.

Local Taxing Jurisdiction Boundary Changes 2021. The North Dakota Department of Revenue is responsible for. The North Dakota State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Dakota State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Find 49900 - 49950 in the.

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

States With Highest And Lowest Sales Tax Rates

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

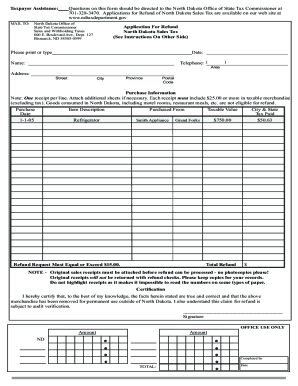

North Dakota Sales Tax Refund For Canadian Residents Fill Online Printable Fillable Blank Pdffiller

The Most And Least Tax Friendly Us States

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Nevada Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Sales Tax Rates By City County 2022

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center